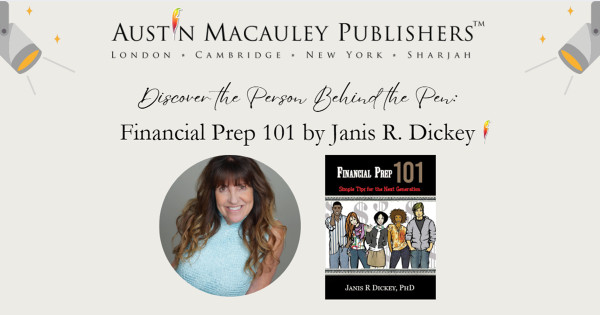

Discover the Person Behind the Pen: Janis R. Dickey

Step into the captivating world of storytelling as we get to know Janis R Dickey, an author whose words in Financial Prep 101: Simple Tips for the Next Generation have engaged readers around the globe. In this exclusive feature, we delve into the inspirations, passions, and creative processes that breathe life into their unforgettable books and projects. Whether you\'re a long-time fan or discovering their work for the first time, this is your chance to uncover the magic behind the pen and get a glimpse into the mind of one of Austin Macauley\'s compelling authors.

Q. What aspects of your own financial journey influenced this book?

I left home after I graduated high school at age 17. I saved $200; I had a job and a childhood friend roommate. In short, I left to make my way and to conquer the financial world. In truth, I was focused on paying my bills, paying for my food and shelter, and saving money for two things: An education, and I wanted to purchase my own home.

My childhood was spent in a household, like others, whose basic needs were met… but, NO EXTRAS. No furniture in the living room, 1 TV, one household car for my father, etc. I wanted to improve my financial circumstances. So, I set out to achieve some lofty goals.

I was bound and determined to support myself by paying my way through school to get a college education. I met and exceeded that goal, later acquiring a PhD in 2000. And, at the same time, I did save money to purchase my first home at the age of 21; today I am in my 18th property. I continuously educated myself regarding financial principles, saving and scrimping as I had seen my parents do. I worked during the day, attended school at night, and saved every penny.

That was my beginning. As I moved through various careers, I eventually settled into being a Financial Advisor. In this capacity I honed my financial skills, helped others in their financial journey and used my continuous quest for knowledge to elevate my own financial position.

Q. What led you to write this book?

My husband, John and I have a blended family with six boys… and current count of grandchildren is 12. One day when John and I were traveling on a cross-country car vacation, I was recounting some of the financial questions our sons were starting to ask me. John merely responded, “Why don’t you write down and share some of the financial tips and answers you know that others don’t?”

When I thought about those questions, and the questions that my clients were asking, I agreed that creating a simple-to-understand financial tutorial was needed.

In short, I chose to write this book because of the need for financial literacy that I have seen during my personal and professional career.

Q. What do you want people to walk away with after they’ve read your book?

Written from a personal perspective, I would like readers to take away a personal understanding of my story and how I was able to navigate the world of finances, in hopes of inspiring them to learn more about financial responsibility and how our financial world works. I present a real-life story (mine and my family’s) of achieving financial success to help readers connect and relate to see how they might apply the principles presented to their own lives.

Ultimately, my quest was to create an “Easy to Read” resource for teens and young adults, and a reference for educators and parents to use with teens and young adults to teach them basic financial concepts.

Finally, I hope my book equips teens and young adults to be more prepared for their financial future.

Q. As we begin the year 2025, what is the best piece of financial advice you can give to your readers?

- Be inquisitive, and 2. practice financial discipline.

The more the readers research effective financial practices, and the more they demonstrate financial stewardship and discipline, the greater the likelihood that they will experience a healthy and productive life. Financial satisfaction can yield a myriad of results: It has been suggested that the less financial stress a person endures, the happier they may be in their daily lives. But don’t take this from me,

|

“No matter who you are, making informed decisions about what to do with your money will help build a more stable financial future for you and your family.”

“To succeed, you will soon learn, as I did, the importance of a solid foundation in the basics of education—literacy, both verbal and numerical, and communication skills.” Alan Greenspan—Federal Reserve System (2002) |

- Bailey, Woodiel, Turner & Young (1998) report that,

“Satisfaction with life has been found to be a counterbalance against stress in both the personal and the work aspects of life.”

And the same seems to be still true today.

- CNBC/Money reported,

“30% of Americans are ‘Constantly’ stressed out about money.” Varo, 3/2018

Q. What is your favorite money-growing habit and practice you have included in your book?

|

“A budget tells us what we can’t afford, but it doesn’t keep us from buying it.” –William Feather |

The topic of Budgeting is an important one for individuals, companies and government agencies. I work best with a plan, and readers probably will as well. Knowing how to create a budget could prove to be invaluable as they begin to manage their money themselves.

Looking ahead will be important. To help plan for the future, I have put together a 5-step approach for creating a budget for readers to review as they consider putting together a budget. Use my ASARR formula (AS ARR). Readers might be able to remember it by saying, “AS you ARR.” Implementing a structured budgeting process is one of the first steps to financial success.

ASARR

- Assess

- Set goals/prioritize

- Analyze

- Reduce/eliminate

- Revise/review

Q. What resources did you use other than “Financial Prep 101” to lead to your financial success?

My book is also a research book, of sorts. I used over 500 urls to research and document the information I share. Most statistics and a good portion of the information is sourced in the book.

Q. Do you think you’ll write another book, or are there any more writing projects you are currently working on?

I am currently working on a different kind of writing project. The project is for a Non-Profit Organization and will present financial literacy in a unique format.

Q. Who is Janis?

Dr. Janis received her Doctorate in Education, Public Affairs and Administration from the University of Missouri, Kansas City. She has 15 years’ experience in sales and marketing management for two Fortune 500 companies: and Janis spent 18+ years as a Financial Advisor when she has held her Series 6 & 7, 63, & 65 Registered Representative and Investment Advisor licenses, Life &; Health Insurance licenses, Property & Casualty Insurance licenses; and she also has held a Real Estate license and was a Real Estate Appraiser and Mortgage Originator. Janis has also taught as an adjunct professor at UMKC.

We use cookies on this site to enhance your user experience and for marketing purposes.

By clicking any link on this page you are giving your consent for us to set cookies